Responsible banking

We place great importance on environmental and social issues and good corporate governance in our operations. How banks manage and facilitate the flow of their financial resources can have a decisive impact on the progress of sustainable development in individual countries and globally because a bank’s greatest impact is in the loans and investments it makes on behalf of its customers.

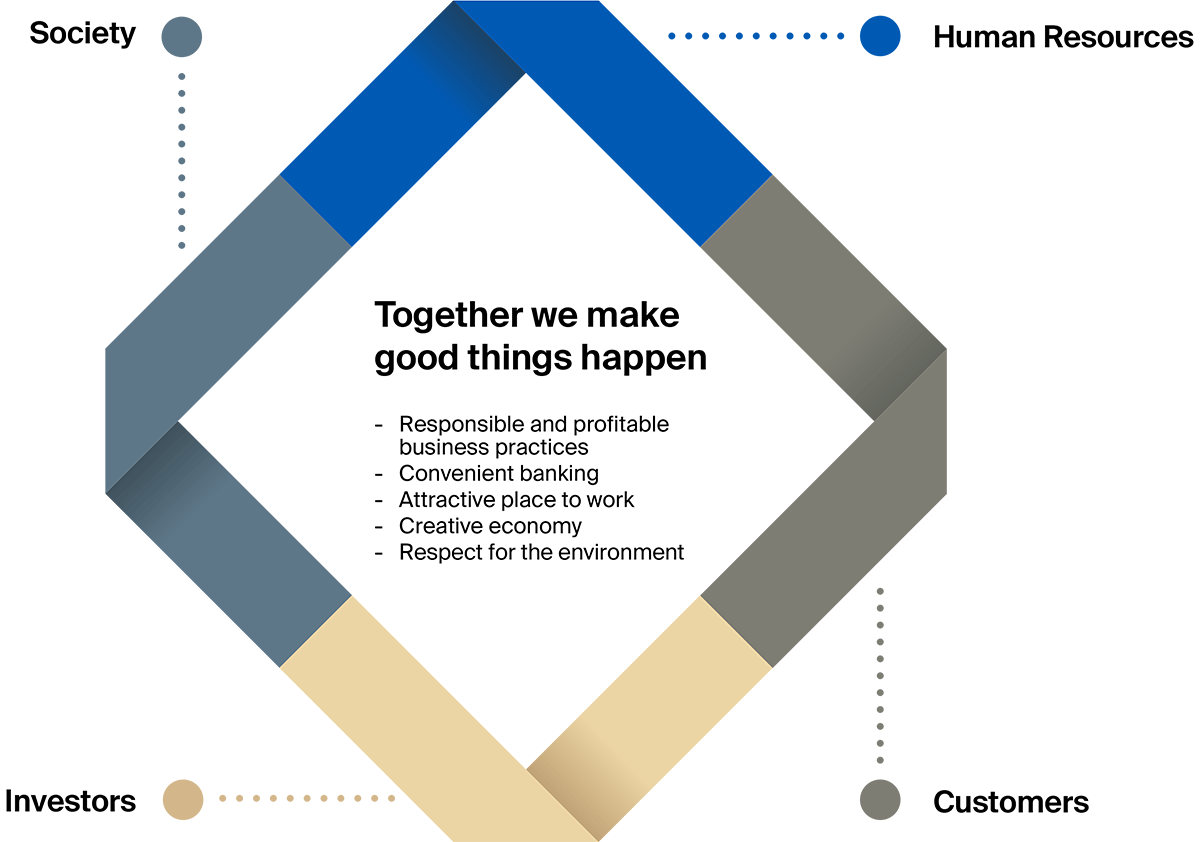

The Bank’s core strategy is to excel by offering smart and reliable financial solutions which create future value for our customers, shareholders and society as a whole. Arion Bank’s sustainability policy bears the title Together we make good things happen and signifies that the Bank wants to act as a role model in responsible and profitable business practices, taking into account the environment, the economy and society. At Arion Bank we aim to ensure that social responsibility and sustainability are part of the Bank's day-to-day activities, its decision-making and processes.

Arion Bank’s core values are designed to provide guidance when making decisions and in everything the employees do. The core values address our role, mentality and conduct and they are: we make a difference, we get things done, we say what we mean, and we find solutions. The Bank’s code of ethics serve as a key to responsible decision-making at Arion Bank.

Sustainability policy

We want to act as a role model by promoting responsible and profitable business practices, which take into account the environment, the economy and the society in which we live and work. We try to see things from our customers’ viewpoint and strive to do better today than we did yesterday.

We work in an attractive workplace where knowledge creates future value for the benefit of our customers, investors and society as a whole.

The diagram below shows our main focuses in sustainability.

Sustainability reporting

Information in the Annual and Sustainability Report has been prepared and published in accordance with the Global Reporting Initiative standard, GRI Standards, which helps companies and institutions share information on sustainability in a transparent and comparable way.

When sharing information on sustainability in operations the ESG reporting guide for the Nasdaq Nordic exchange and the 10 Principles of the UN Global Compact are also used a reference. The Bank also looks to the UN Sustainable Development Goals. We are also reporting on the progress made in implementing the UN Principles for Responsible Banking to which Arion Bank became a signatory in September 2019.

For the third time Deloitte has provided an opinion with limited assurance on disclosure in connection with Arion Bank’s Annual and Sustainability Report. Deloitte has also provided an opinion with limited assurance on the Bank’s progress report to PRB for the first time.

Arion Bank maintains outstanding ESG rating

from Reitun

Arion Bank achieved the score “outstanding” in Reitun’s ESG rating in 2022, scoring 90 out of 100 possible points and placing it in category A3. The rating is based on the Bank’s performance in ESG issues in its operations. The Bank performs well above average in all categories. A total of 35 issuers have been rated by Reitun. This is the third year in row the Bank has achieved this score. Further information on the results of the ESG rating can be found here.

Strong ESG rating from Sustainalytics

In 2022 the Bank was rated by the international ratings agency Sustainalytics, which specializes in rating risk related to ESG issues. The rating was positive and Sustainalytics considers Arion Bank to be one of the best performing banks globally in this area. The Bank scored 12 points on a scale from 0-100, with a lower score signifying lower risk. Sustainalytics therefore believes there is minimal risk of significant financial damage due to ESG issues at the Bank. Arion Bank is in the top 6% of more than 1,000 banks worldwide which have been rated by Sustainalytics and in the top 4% of 400 regional banks.

UN Sustainable Development Goals

The Bank has selected six UN Sustainable Development Goals which the Bank intends to focus on. These goals are number 5 on gender equality; number 7 on affordable and clean energy; number 8 on decent work and economic growth; number 9 on industry, innovation and infrastructure; number 12 on responsible consumption and production; and number 13 on climate action.

The Bank’s operations, including action on gender equality, our policy and actions on environment and climate issues, support for innovation and the business sector as a whole, state-of-the-art digital services and active participation on the development of the economy closely align with these sustainable development goals.

Governance, sustainability and risk management

Arion Bank has a sustainability committee and the management of risk in connection with ESG factors was defined as part of the Bank’s risk management system. The CEO is the chairman of the committee, whose role is to monitor the Bank’s performance in connection with its policy and commitment on sustainability and to ensure that ESG factors are considered in decisions and plans made by the Bank. A green financing committee and equality committee are sub-committees of this committee.

In addition to the CEO, the sustainability committee includes the managing directors of Retail Banking, Corporate & Investment Banking, Markets, Customer Experience and Finance. The Chief Risk Officer, the Head of Corporate Communications and Sustainability, and Sustainability Officer attend meetings but do not have voting rights. Meetings are also attended by representatives of Stefnir and Vörður if required. The Bank has adopted a risk policy on sustainability which is approved by the Board of Directors and reviewed annually. This policy states that the Bank seeks to ensure that its operations and services do not have a negative impact on people or the environment. It also states that the Bank supports Iceland’s climate action plan whose goal is to meet the obligations of the Paris Climate Agreement and to achieve the ambitious goal of carbon neutrality in Iceland by 2040. Key performance indicators relating to ESG issues were added to the monthly risk report to the Board and the Bank’s risk appetite connected to these issues was defined.

At the beginning of 2022 a special risk assessment of ESG issues at the Bank was made, and the assessment was reviewed at the beginning of 2023. The main social risks relate to employee equality and diversity, disclosure and relations with stakeholders. The main environmental risks were insufficient action in environmental and climate issues in connection with goods and services, employees’ compliance with the Bank’s environment and climate policy and the risk of greenwashing. The assessment also revealed that the main governance risks were anti-money laundering measures and know-your-customer, data protection and ESG reporting. The management of these risk at the Bank was rated as adequate or strong.

At the end of the year the Board of Directors approved an updated bonus scheme for permanent employees which is based on clear targets and subject to strict requirements from the FSA. In 2023 both financial and non-financial indicators will be incorporated into the scheme. Non-financial indicators are linked to factors such as customer satisfaction, know-your-customer, learning and development, and equality.

The Bank has introduced a policy on actions against financial crime, such as money laundering, terrorist financing, bribery and corruption or market abuse. On the basis of this policy the Bank places great importance on knowing all customers and understanding their business so that the Bank is able to identify any suspicious transactions. Further information on governance and risk management in relation to ESG and actions against financial crime can be found in the Bank’s 2022 Pillar 3 Risk Disclosures.

Responsible lending and investment

Arion Bank is a signatory to the United Nations Principles for Responsible Banking (PRB). The goal of these principles is to align banking with international goals and commitments such as the UN Sustainable Development Goals and the Paris Climate Agreement. In 2022 we continued to implement the principles into our business.

In order to adapt our strategy to PRB and the goals of the Paris Climate Agreement, we have adopted an environment and climate policy and goals which are reviewed and updated annually. More information on the Bank’s environment and climate policy and targets can be seen here. The Bank’s credit policy places an emphasis on sustainability and increasing the percentage of green loans, and quantifiable targets have been set. The Bank’s credit rules also stipulate that environmental, social and governance factors must be considered when assessing loans. In 2023, we will continue to make ESG factors more important when assessing loans.

We aim to help our customers continue to make a difference and to develop strong and fruitful business relationships. In order to allow our business relationships to thrive, it is important to us that our corporate customers do not have a negative impact on people or the environment. One of the Bank’s sustainability goals in 2022 was to begin setting out sustainability policies in various sectors. The first policy for the seafood industry was devised in 2022, and at the beginning of 2023 it was approved by the Bank’s sustainability committee. The policy took on board the opinions of stakeholders and plans and actions in connection with ESG factors in this sector, which is fundamental to the Icelandic economy and which also forms a critical component of the Bank’s loan book.

Arion Bank’s Sustainability Policy on Seafood

In 2021 the Bank published a comprehensive green financing framework and has since then held four green bond issues based on the framework, two of which were in 2022. Green deposits continued to grow in 2022, and there was a significant increase in loans to buy vehicles which run on 100% renewables.

Arion Bank and its subsidiary Stefnir had ISK 1,298 billion in assets under management at the end of 2022. In asset management, Arion Bank has introduced rules of procedure on responsible investment which incorporate the three basic criteria of sustainability: environment, social and governance. The Bank is a signatory to the United Nations Principles for Responsible Investment (PRI) and has published progress reports since 2019. This means that not only financial criteria, but also other relevant criteria, are taken into account when analyzing investments and developing clients’ asset portfolios.

Responsible buying

The Bank's strategy is to create future value for the benefit of its customers, shareholders and society as a whole, and in keeping with this the Bank seeks to source its supplies from local providers as far as possible, provided they meet the requirements on quality and price.

Nearly all of the Bank’s key suppliers operate in Iceland. Although the supply chain does extend overseas, the first link is usually here on the domestic market. In fact there is only one international supplier in the top 10 main suppliers and only 9 in the top 50. The majority of the Bank’s international suppliers are connected to the buying of software, advisory services and IT services. Hardware is almost entirely acquired from Icelandic suppliers.

Buying is divided between the 50 main suppliers as follows: domestic 86% and international 14%.

Buying is divided between the 50 main suppliers as follows

The Bank’s environment and climate policy requires our suppliers to take into account the environmental and climate impact of their activities. Furthermore, when comparing similar offers from suppliers, environmental and climate considerations will be decisive in our decision. The Bank’s buying rules take this into account.

The Bank’s supplier assessment, which is now in digital format, appraises suppliers on their performance in terms of environmental and climate issues, as well as equality and labour laws. The supplier assessment is available in Icelandic and English and is carried out on suppliers over a certain size. During the year a total of 92% of new suppliers which come under this definition and have an agreement with the Bank underwent the assessment. The Bank regularly assesses the performance of suppliers with which it has long-term business relationships, and all the largest suppliers with which the Bank has made outsourcing agreements underwent the assessment in 2022.

The code of conduct for suppliers, which focuses on sustainability and social responsibility, is available on the Bank’s website. The code of conduct is incorporated in the digital supplier assessment and forms part of the agreement with the Bank.

Contractors

At the beginning of the year a new procedure for contractors was introduced. They are divided into three categories depending on type of access permissions and scope of work. Contractors are people who work on a specific project, in the short term or long term, for the Bank but who are not employees of the Bank. The total number of active contractors at the end of 2022 was 282. Examples of contractors are people who work in real estate services and property management, maintenance and cleaning, auditors and advisors. Most contractors who work for the Bank are programmers, people providing monitoring services such as security and other specialists.

Donations to political activities

Arion Bank has adopted a policy concerning donations to political activities. The policy states that the Bank provides grants to political organizations which put up candidates nationally in general elections and submit an application for financial support from the Bank. To be eligible for a grant the organization must have a member of parliament.

No donations to political activities were made in 2022.

POLICY ON DONATIONS TO POLITICAL ACTIVITIES

Responsible product management, product range and one-to-one marketing

Arion Bank adheres to a policy on responsible product management, product range and marketing, and compliance with the policy is the responsibility of the managing directors of Retail Banking and Customer Experience. The policy states that the Bank endeavours to offer products and services which are beneficial to our customers, shareholders and society as a whole. The rules of procedure on product management are defined and take into account the European Banking Association’s guidelines on product oversight and governance arrangements for retail banking products. These rules of procedure continued to be developed during the year.

The Bank protects its customers’ interests when developing the Bank’s products and seeks to ensure as far as possible that they receive products and services suitable for them. The Bank attaches great importance to employees’ having a thorough knowledge of the rules which apply to their fields of work, and an annual learning programme on responsible product management and marketing was introduced. Employees engaged in product development, such as product managers, employees of Marketing and management, took mandatory learning programmes and approximately 80% of them completed the programmes. The Bank records and categorizes recommendations and complaints by product and nature of service and shares this information with the Central Bank of Iceland.

POLICY ON RESPONSIBLE PRODUCT MANAGEMENT, PRODUCT RANGE AND ONE-TO-ONE MARKETING

Our commitment to sustainability

UNEP FI and Principles for Responsible Banking - PRB

In July 2019 Arion Bank became a signatory to UNEP FI, United Nations Environment Programme Finance Initiative, which is a partnership between United Nations Environment and financial institutions across the world working to understand today’s environmental, social and governance challenges.

In September 2019, Arion Bank became a signatory to the Principles for Responsible Banking (PRI) which were devised by UNEP FI and 30 international banks. For further information on Arion Bank’s involvement with the principles see here.

An overview of the progress made by the Bank in implementing the principles at Arion Bank can be seen here.

Forum for climate issues and green solutions – Green by Iceland

Arion Bank is one the founding members of Green by Iceland, a joint business and government forum on climate issues and green solutions. Green by Iceland brings together Icelandic companies and the authorities to cooperate on shared goals on a carbon neutral Iceland by 2040. It also promotes Icelandic green solutions internationally under the name Green by Iceland in partnership with Business Iceland.

At the beginning of 2020 the Bank signed up for the challenge Hreinn, 2 og 3! organized by Green by Iceland, where companies are encouraged to make the transition to 100% renewable energy for their vehicles. Under this initiative, the use of new corporate cars powered by fossil fuels will be discontinued by 2023. This will make Iceland a global leader in the use of environmentally friendly fuels. This is in line with the targets set out in our environment and climate policy which states that no new vehicles will be bought from 2023 unless they run on 100% renewable energy.

United Nations Principles for Responsible Investment – UN PRI

In 2017 the Bank became a signatory to the United Nations Principles for Responsible Investment (UN PRI). The principles are designed to help investors understand the effect of environmental, social and governance issues on investment and thereby encourage signatories to the principles to take non-financial factors into account when making investment decisions. A progress report on responsible investment is published annually by the Bank’s Asset Management division. For more information on responsible investments see the Markets section.

UN Global Compact – the UN’s initiative on sustainability

Arion Bank has been a signatory to the UN Global Compact, the UN's initiative to encourage businesses to adopt sustainable and socially responsible practices, since the end of 2016. The compact sets out 10 principles on human rights, the labour market, the environment and anti-corruption. The Bank submits an annual progress report to Global Compact.

IcelandSIF - Iceland Sustainable Investment Forum

Arion Bank has long been an active participant in the shaping and development of responsible investment in Iceland and was one of the founding members of IcelandSIF, the Iceland Sustainable Investment Forum, in 2017. Over the years the Bank has had representatives in the board and working groups for the organization. The chairwoman of IcelandSIF is Kristbjörg M. Kristinsdóttir, CFO of Stefnir, a subsidiary of Arion Bank.

Excellence in corporate governance

Arion Bank has been recognized as a company which had achieved excellence in corporate governance following a formal assessment based on guidelines on corporate governance issued by the Icelandic Chamber of Commerce, the Confederation of Icelandic Employers, and Nasdaq Iceland. Arion Bank was first recognized for excellence in corporate governance in 2016. This recognition is given following a comprehensive audit by an independent party of corporate governance at the Bank, such as governance by the Board of Directors, sub-committees and management. It applies for three years. For more information on corporate governance at Arion Bank see here and the sustainability accounts for 2022.

Festa – Center for Sustainability

Arion Bank has been an active partner of Festa, a sustainability centre, for several years. Festa’s role is to further expertise on social responsibility and sustainability at companies, institutions and organizations. This year the Bank made an additional financial contribution to Festa and is now classed as a core company.

City of Reykjavík and Festa’s Declaration on Climate Change

In 2015 Arion Bank became one of more than 100 signatories to the City of Reykjavík and Festa’s Declaration on Climate Change. One of the main tasks concerning climate change is to map the environmental impact of operations and to systematically reduce the negative effects. We have published the Bank’s environmental accounts annually since 2016. More information on Arion Bank’s environmental accounts can be seen here and in the sustainability accounts for 2022.

Declaration of intent on investment for a sustainable recovery

On 25 September 2020 Arion Bank signed a declaration of intent on investment for a sustainable recovery. The Prime Minister’s Office, Festa – Center for Sustainability, the Icelandic Financial Services Association (SFF) and the National Association of Pension Funds (LL) devised the declaration in close cooperation with representatives of the main participants in the financial market. The declaration of intent conforms to Arion Bank’s policy and goals on greater sustainability.

Ministry of Welfare’s equal pay symbol,

In the autumn of 2018 Arion Bank was awarded the Ministry of Welfare’s equal pay symbol after having been certified by the standards agency BSI in Iceland, the first Icelandic bank to gain this recognition. The Bank first gained equal pay certification in 2015 and has since undergone a pay assessment annually. For more information on equality at Arion Bank see the section on Human Resources and the sustainability accounts for 2022.

UN Women and UN Global Compact

The Bank has supported the UN Women/UN Global Compact Empowerment Principles since 2014. These are international declarations and treaties under the auspices of the United Nations which companies and institutions can use as guidelines when implementing responsible working practices, irrespective of geographic location or sector and which primarily concern advancing gender equality. For further information see the sections on equality at Arion Bank and the sustainability accounts for 2022.

FKA Equality Scale

In 2020 CEO Benedikt Gíslason signed a declaration of intent on the Equality Scale, stating that over the next few years Arion Bank intends make a focused effort to balance out the gender ratio at senior management level. The Equality Scale is an initiative created by the Association of Icelandic Businesswomen (FKA).

Aspiration and Seven Glaciers

At the beginning of 2023 Arion Bank and Aspiration signed an agreement on the acquisition of verified carbon credits. The transaction was made through Seven Glaciers in Iceland and involves the acquisition of 600 verified and active carbon credits. The units are integral to Arion Bank’s mitigation measures for emissions from own activities in 2022, such as from business premises, vehicles, flights, waste and employee journeys to and from work.

Nasdaq ESG reporting guide

The ESG Reporting Guide for the Nasdaq Nordic exchanges provides guidance on data disclosure and the environmental, social and governance impact of listed companies. Since 2016 Arion Bank has used these criteria when reporting on sustainability. The criteria formally came into effect in 2017 and a second edition of the reporting guide came out in 2019. For more information on ESG reporting see sustainability accounts.

PCAF – Partnership for Carbon Accounting Financials

In 2021 Arion Bank became a signatory to the Partnership for Carbon Accounting Financials (PCAF). This is a global partnership of financial institutions that work together to develop and implement a harmonized approach to assess and disclose the greenhouse gas (GHG) emissions associated with their loans and investments. At the end of 2022 Arion Bank published its first report on financed emissions which is based on PCAF methodology. Assessing and disclosing the GHG emissions which are financed through lending and investments is a prerequisite for the Bank’s ability able to set targets on reducing emissions, and this is the next step.

CDP

Since 2019 Arion Bank has disclosed its climate impact via CDP, a non-profit charity that runs the global disclosure system for investors, companies, cities, states and regions to manage their environmental impacts. More than 13,000 companies published their environmental data via CPD in 2022. See here for more information on CDP.

TCFD

In order to gain a better overview of the risk related to climate change the Bank has for the third time made use of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The section on sustainability risk in the Bank’s 2022 Pillar 3 Risk Disclosures is partly based on these guidelines and it also contains an analysis of the Bank’s loan portfolio from the point of view of climate risk. The Bank formally became a signatory to TCFD in February 2022. For more information refer to the Pillar 3 Risk Disclosures for 2022.

Supporting the community

Arion Bank organizes a wide range of informative lectures, conferences and events and is an active member of the community. The Bank received a large number of visitors over the year and we also participated in numerous conferences and exhibitions.

Events held in 2022 included

- High school students visited the headquarters and learned about investment.

- In partnership with the Association of Icelandic Businesswomen, the Bank held an event which brought together more than 300 women from the business sector.

- The Bank’s Chief Economist, Erna Björg Sverrisdóttir, presented the latest economic forecast to customers.

- Ferran Soriano, chief executive officer of Manchester City held a presentation for customers and employees entitled “Management lessons from the football world.”

- The Arion Invitational chess tournament was held in September, with Guðmundur Kjartansson emerging as the winner.

- The Bank hosted a ladies night event in connection with Pink October and collected ISK 1.8 million for the Icelandic Cancer Society.

- The Bank sponsored a major retrospective exhibition of the works of Birgir Andrésson at Kjarvalsstaðir in January and held several events linked to the exhibition for customers, including guided tours for families and a special premiere event.

- Icelandic Standards, Arion Bank, Deloitte Iceland, International Carbon Registry and Klappir Green Solutions held an open meeting on carbon offsetting at the Bank’s headquarters. Presentations were given on a new technical specification on carbon offsetting and how it can be used to help companies carbon offset their activities and in the production of verified carbon units.

- Numerous other companies and customers visited the Bank, and events included investor days in the intellectual property industry and aquaculture, fintech day, visits from pilots, car dealers, young investors, the association of women in IT and MBA students from Reykjavík University

New sponsorship policy

Arion Bank collaborates with numerous organizations and companies and supports a wide range of good causes in the community. Towards the end of 2022 the Bank approved a new sponsorship policy where the emphasis is on sponsoring projects connected to the Bank’s core activities or which support the UN Sustainable Development Goals, with a particular focus on the goals highlighted by the Bank:

- Gender Equality (5)

- Affordable and clean energy (7)

- Decent work and economic growth (8)

- Industry, innovation and infrastructure (9)

- Responsible consumption and production (12)

- Climate action (13)

ESG factors are also taken into account when selecting recipients of sponsorship and partners. The sponsorship process is well defined and transparent.

Sponsorship in 2022

Sponsorship and partnerships in 2022

- Arion Bank was one of the main sponsors of the Arctic Circle conference held at Harpa Concert Hall in October. The aim of the conference was support the dialogue and collaboration on the future and development of the Arctic, a region whose importance will increase in the coming decades, not least because of climate change. The conference was attended by influential people from the worlds of politics, economics, academia and NGOs.

- Arion Bank sponsors the Dean’s List at Reykjavík University, which is reserved for students who achieve the best results in each semester. The aim of the list is to inspire students who gain outstanding academic results and to highlight their achievements. Students on the RU Dean’s List have their tuition fees for the next semester waived.

- Arion Bank customers joined the Bank in sponsoring the efforts of the Icelandic Red Cross to receive refugees in Iceland. More than ISK 5 million was raised in collection boxes at our branches throughout Iceland and the Bank matched this amount.

- Arion Bank is one of the main sponsors of the Icelandic Handball Association and has been providing backing for the sport in Iceland for many years.

- Arion Bank is one of the main sponsors of the Icelandic Sports Association for the Disabled and is helping athletes prepare for competitions during the year.

- Arion Bank supported the Association of Icelandic Businesswomen in 2022, for example hosting their event Visibility Day.

- The Bank supports the Icelandic Forestry Association, helping to fund an initiative to further advance public knowledge of forests, provide information and improve access to forests for recreational purposes. The Bank also provides funding to plant trees.

- At the end of the year Arion Bank and Icelandic start-up SoGreen signed a partnership agreement on the acquisition of future carbon units to fund education for girls in Zambia. The Bank is one of a diverse group of companies, funds, societies and institutions forming a pioneering team which is helping turn SoGreen projects in Zambia into reality.

- The Bank also supports a range of charitable causes such as the Icelandic Cancer Society and the branches support diverse causes in their local areas

Innovation and support for entrepreneurs

Innovation is integral to our business and improves the Bank’s ability to compete in the long term. Continuous and focused scrutiny of whether the current methodology applied to goods, services and processes is optimal for success is one of the keys to our operations.

In recent years the Bank has collaborated on a wide range of exciting investment projects with our customers with the aim of strengthening the business sector in this country. This is particularly true of the intellectual property industry, a flourishing sector in Iceland and a vital source of future value creation. We are committed to supporting innovators and we nurture innovation and growth through partnerships with selected partners.

Arion Bank’s commitment to innovation and active participation in the development of a creative economy supports two of the UN’s sustainable development goals, namely goal number 8, decent work and economic growth, and goal number 9, industry, innovation and infrastructure.

Arion Bank has invested directly and indirectly in numerous start-ups and participated in events related to innovation.

.jpg)

Strategic partners

Enhanced service to people

on the rental market through Leiguskjól

Leiguskjól is an excellent example of a partner selected by the Bank to support the services offered by the Bank. Leiguskjól participated in Startup Reykjavík in 2018, and the Bank invested in the company, acquiring a 6% interest. In 2019 the Bank entered into a partnership agreement with the company and increased its investment to 51%. The investment and partnership agreement with Leiguskjól clearly demonstrates the Bank’s commitment to stepping up its collaboration with fintech companies, where the aim is to utilize the Bank’s core strengths and to combine it with the focus and dynamism inherent in innovation.

.png)

Eyrir Sprotar – investing in startups

Arion Bank, in cooperation with Eyrir Invest, runs the venture capital fund Eyrir Sprotar slhf. Eyrir Invest and Arion Bank are the fund's largest shareholders. The fund is worth ISK 6 billion and has invested in 11 companies.

.png)

Advancing innovation on the financial market with the Fintech Cluster

Arion Bank is a member of the Fintech Cluster, an organization designed to advance innovation in the financial sector. The Fintech Cluster also runs an innovation centre and organizes a range of events. In partnership with the Fintech Cluster, Arion Bank held a special fintech event whose aim was to present the Cluster’s innovation companies.

.jpg)

Supporting young entrepreneurs

Arion Bank is one of the main sponsors of Junior Achievement Iceland. The role of this organization is to prepare young people for the future and to improve their skills for the job market and by promoting education in innovation, entrepreneurship and business at secondary school level. In 2022 it organized a competition for secondary school students which gave students the chance to experience innovation first hand in the classroom. A total of 124 companies were set up in the competition and 35 went through to the final. The company HAF vítamín, owned by six students from Menntaskólinn við Sund, was named company of the year and represented Iceland at the JA Europe Company of the Year Competition held in Estonia.

Leitar Capital Partners – investing in entrepreneurs

During the year Arion Bank invested in Leitar Capital Partners ehf. and the company’s first fund. Leitar Capital Partners is a new company which focuses on investing in young and dynamic people and helps them find companies to acquire and manage. The company is a registered alternative investment fund manager and has completed the ISK 1.5 billion funding of the company’s first investment fund. The investment fund will invest in search funds, a search fund being an investment vehicle through which an entrepreneur, the searcher, raises funds from investors. The searcher gets funds to search for a suitable company to buy, takes over as managing director, gets a share in the company and then manages it as it transforms and grows until it is sold again. The aim of the project is to combine the energy of young and ambitious entrepreneurs with the experience and expertise of dynamic investors by acquiring promising companies full of growth potential.

Frágangur – investing in startups

Arion Bank acquired a 33% interest in the company Bílafrágangur ehf. during the year. It is an innovation company which was founded in 2020 and its aim is to use digital solutions to enhance security and consumer protection when buying cars. The solutions offered by Frágangur enable people buying a vehicle to have secure, simple and quick transactions. The solution covers all the paperwork involved in the transaction, including purchase agreements, change of ownership documents and financing.

The company HAF vítamín, owned by six students from Menntaskólinn við Sund, was named company of the year for 2022 in the Junior Achievement Iceland Competition.