Environmental and climate issues

Environmental and climate issues are close to our heart at Arion Bank. We want to ensure that we have a comprehensive overview of the environmental impact of our day-to-day activities and to minimize the negative effects. We realize that the greatest impact that banks have on environmental and climate issues is through lending and investment, and we take this responsibility seriously.

.jpg)

Arion Bank became a signatory to the City of Reykjavík and Festa’s Declaration on Climate Change in 2015, and our initial focus was mainly on increasing awareness and understanding of environmental and climate change issues among our employees and reducing emissions from our activities. We are proud of our green journey, and our focus on environmental and climate issues is increasingly embodied in the Bank’s range of services and products. Directing financial resources towards green development and the circular economy is hugely important in the fight against climate change and we fully intend to continue in this direction.

See the sections on green finance and responsible banking for further information.

Arion Bank’s environment and climate policy

We aim to be a role model on environmental and climate issues and to minimize greenhouse gas emissions and the negative environmental impact of our activities. Man-made climate change is one of the greatest challenges of our time and it is critical that global warming is restricted to below 1.5 degrees Celsius. We are committed to helping Iceland meet its obligations under the Paris Climate Agreement and other domestic and international environment and climate treaties and to reach the ambitious goal of a carbon neutral Iceland by 2040.

Banks perform a vital role in funding progress and our focus is on funding projects on sustainability and green infrastructure.

We also require our suppliers to consider the environmental and climate impact of their activities. When comparing similar offers from suppliers, environmental and climate considerations will be decisive in our decision. The Bank’s goal is to reduce emissions of carbon dioxide and other greenhouse gases from our activities by at least 55% by 2030 from the base year 2015 and to carbon offset all remaining emissions.

We are setting ambitious targets and will publish the results of our progress in areas where we have the greatest impact, such as buying, our own activities and the services we provide to our customers. We endeavour to enhance our employees' knowledge and understanding of environmental issues and to support our customers' journey towards a green future in accordance with the UN Sustainable Development Goals.

Targets relating to our environment and climate policy

In 2022 we will set a target on green loans as a percentage of total loans up to 2030.

Status: Completed – target will be reviewed annually.

The percentage of green loans which come under the Green Financing Framework is currently 12.5% of the Bank’s total loan portfolio, which was ISK 1.085 billion at year-end. The Bank aims to increase this figure to at least 20% by 2030. By setting this target the Bank aims to increase its green lending so that the annual growth rate of the green loan book is double the growth rate of the Bank’s total loan book. This target on the ratio of green loans will be reviewed annually, taking into consideration the opportunities over the next few years for green financing and the implementation of EU taxonomy in Iceland. The Bank hopes the growth rate might even exceed the target figure.

In 2022 we will adopt a policy concerning those sectors in which our loans have the greatest impact in terms of environmental and climate considerations.

Status: Partly completed.

One of the Bank’s sustainability goals in 2022 was to begin devising sustainability policies in various sectors. The first policy for the seafood industry was devised in 2022, and at the beginning of 2023 it was approved by the Bank’s sustainability committee. The policy took on board the opinions of stakeholders and plans and actions on ESG factors in this sector, which is fundamental to the Icelandic economy and also forms a critical component of the Bank’s loan book. In 2023, we will devise more policies connected to the sectors which have the greatest impact on our loan portfolio in terms of climate and environmental factors.

We will ask our main suppliers about the environmental and climate impact of their activities.

Status: Completed – continuously in progress

The Bank’s environment and climate policy requires our suppliers to take into account the environmental and climate impact of their activities. Furthermore, when comparing similar offers from suppliers, environmental and climate considerations will be decisive in our decision. The Bank’s buying rules take this into account.

The Bank’s supplier assessment appraises suppliers on their performance in terms of environmental and climate issues, as well as equality and labour laws. The supplier assessment is carried out on suppliers over a certain size. During the year a total of 92% of new suppliers which come under this definition and have an agreement with the Bank underwent the assessment.

In 2022 we are going to start measuring the carbon footprint of our loan portfolio in accordance with PCAF. Once we have obtained a clear picture of the loan portfolio’s carbon footprint, we will set ourselves a target on how to reduce the footprint up to 2030 in accordance with the objectives of the Paris Climate Agreement.

Status: Partly completed.

The Bank’s first report on financed emissions was published during the year. Assessing and disclosing the GHG emissions which are financed through lending and investments is a prerequisite for the Bank’s ability able to set targets on reducing emissions, and this is the next step.

From 2023 the Bank will no longer buy vehicles which do not run on 100% renewable energy.

Status: Not yet due – positive progress.

71% of all vehicles owned by the Bank are either plug-in hybrids or electric cars, and 100% of the cars owned by the Bank and used by employees for daily tasks (buying, meetings, etc.) are plug-in hybrids or electric cars.

The transition to renewable energy in vehicles owned by the Bank is therefore making good progress. From 1 January 2023 the Bank will no longer buy any vehicles which do not run on 100% renewables.

We intend to increase the ratio of sorted waste produced by the Bank to 90% by 2023.

Status: Not completed – positive progress.

The Bank’s target of increasing the percentage of sorted waste to 90% by 2023 was highly ambitious. Although excellent progress has been made, the 90% sorting rate was not achieved in 2022. The percentage of sorted waste was 80.1% in 2022. The Bank is on the right track and continues to work towards the 90% target.

The Bank’s goal is to reduce emissions of carbon dioxide and other greenhouse gases from our activities by at least 55% by 2030 compared with 2015 and to carbon offset all these emissions.

Status: Not yet due – positive progress.

Originally, the Bank’s target was to reduce emissions from activities by 40% by 2030, i.e. from business premises and vehicles (Scopes 1 and 2). By the end of 2020 the Bank had reduced emissions by 34.7% and it was therefore considered appropriate to update the target and to reduce emissions by 55% by 2030. By the end of 2022 emissions were 55.6% down on the base year of 2015 and the target will be reviewed in 2023. For more information see the Bank’s 2022 environmental accounts below and the section on environmental factors in the sustainability accounts.

Financed carbon emissions from lending and investments at Arion Bank in 2022

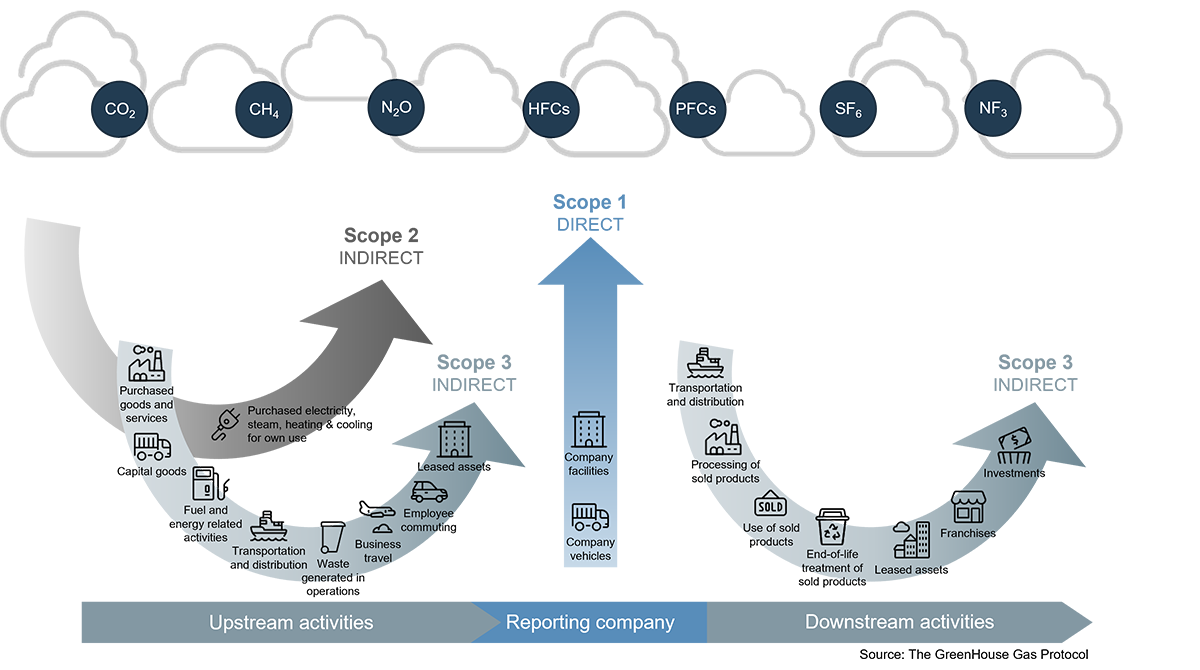

Arion Bank is a signatory to the Partnership for Carbon Accounting Financials (PCAF) which is a global partnership of financial institutions that work together to develop and implement a harmonized approach to assess and disclose the greenhouse gas emissions which they finance through their loans and investments (Scope 3). Although the Bank’s operations impact the environment, its greatest environmental impact is through its lending and investments. Knowledge of the carbon footprint of the Bank’s loans and investment is a critical component of managing climate risk and setting environmental and climate goals.

At the end of 2022 Arion Bank published its first report on the scope of financed carbon emissions from lending and investments in 2021. The main conclusion of the report was that the Bank’s financed emissions in 2021 amounted to 279.4 ktCO2e, and these emissions originate almost entirely from the loan portfolio, mainly business loans, or 95%. The Bank’s financed emissions from investments and lending are 776 times greater than total emissions from the Bank’s operations.

Total carbon emissions in 2021

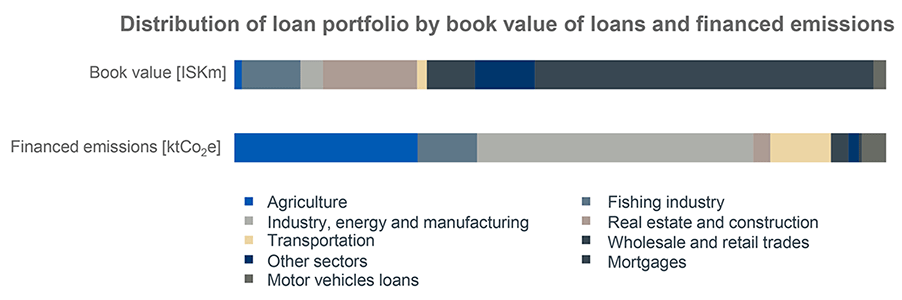

Financed emissions by sector in 2021

Loan book by sector

The sector which generated the highest emissions in the loan portfolio was industry, energy and manufacturing with emissions of 117.4 ktCO2e. This category is the sixth largest sector in terms of the loan amount but has the second highest emission intensity or 4.3 tCO2 e/ISKm. It was followed by agriculture with emissions of 78.1 ktCO2e and an emission intensity of 7.9tCO2e/ISKm which is the highest emission intensity of all the Bank’s loans. This means that in Arion Bank’s loan portfolio in 2021, loans to agriculture have the highest carbon emissions per króna loaned. The sectors with the highest loan volumes in the Bank’s loan portfolio are seafood, with financed emissions of 25.1 ktCO2e, and real estate and construction, with emissions of 7.0 ktCO2e.

Next after business loans in terms of financed emissions are motor vehicle loans, with financed emissions of 10.4 ktCO2e. Government policy means that emissions from vehicles can be expected to decrease significantly over the next few years and it will be prohibited to import cars which run on fossil fuels from 2030.

Estimated financed emissions from mortgages to retail customers amount to approximately 1.2 ktCO2e which is a tiny figure in relative terms considering that this loan category represents around 50% of the total loan portfolio. This is largely thanks to Iceland’s renewable energy resources, geothermal power and hydropower.

Financed emissions from the Arion Bank Group’s asset portfolio was approximately 2.5 ktCO2e. Most investments in the Group’s portfolio are not considered polluting industries. The majority of emissions in this category originate from companies involved in air passenger transportation to and from Iceland. Other sectors which are major contributors to these emissions are seafood and shipping.

The report and an explanation of the methodology used can be seen here.

Highlights of Arion Bank’s environmental accounts for 2022

We have reported on the status and actions in environmental and climate issues since 2016. The base year for the Bank’s environmental accounts is 2015, and our goal is to have reduced emissions from own activities by 55% by 2030. The highlights of Arion Bank’s environmental accounts for 2022 can be seen below. Details of the environmental accounts can be found in the Bank’s sustainability accounts under the section environmental factors.

Total emissions of greenhouse gases from own operations, i.e. from vehicles and business premises, have decreased by 55.6% since 2015 (Scope 1 and 2). Of this total, total emissions from vehicles decreased by 66.5% and from business premises by 45.7%. As before, the main opportunity for further reducing emissions from the Bank’s activities is to completely stop buying fuel for vehicles. The Bank has decided that from 2023 it will no longer buy vehicles unless they run 100% on renewables.

The amount of floorspace in the Bank’s business premises has been significantly reduced in line with the greater focus on digital services. This has resulted in a sharp decrease in emissions from own business premises in Scope 2. However, it must be noted that part of the emissions from own business premises has been transferred from Scope 2 to Scope 3 since the Bank has in some cases sold property and leased it again.

This year emissions from the subsidiaries Vörður and Stefnir, which share their headquarters with the Bank, have been included in the calculations of the Bank’s environmental accounts and the emissions for the subsidiaries have been deducted from Scope 2 and transferred over to Scope 3. The percentage of waste in the companies’ activities was also calculated with respect to the number of employees.

Greenhouse gas emissions from vehicles (Scope 1)

Greenhouse gas emissions from business premises* (Scope 2)

Total emissions from vehicles and business premises with targets up to 2030 (excluding mitigation measures)

Arion Bank takes mitigation measures for emissions which cannot be prevented. At the end of 2022 it was decided to buy verified carbon units for the first time from the company Aspiration through Seven Glaciers. The Bank acquired carbon units corresponding to 600 tCO2e to offset emissions for which the Bank is directly responsible (Scope 1 and 2) during the year. Carbon units were also purchased for other areas of activities (Scope 3), such as for business trips, waste and employee journeys to and from work.

At the end of the year Arion Bank and the Icelandic start-up SoGreen signed a partnership agreement on the acquisition of future carbon units to fund education for girls in Zambia. The Bank is one of a diverse group of companies, funds, societies and institutions forming a pioneering team which is helping turn SoGreen projects in Zambia into reality.

The Bank has also provided generous financial support to the Icelandic Forestry Association for many years and will continue to do so.

Total greenhouse gas emissions in Scope 3 (excluding mitigation measures and financed emissions)

Enhanced data collection has enabled us obtain better information on acquired services (Scope 3). In 2015-2018 international flights, flights by contractors, flights with international airlines, taxi journeys and data destruction have been added to the Bank’s environmental accounts, which partly explains why recorded total emissions of greenhouse gases from acquired services have increased during the period.

In 2020 employee journeys to and from work were added. In addition emissions from leased and leased out assets were added to Scope 3 in 2022. Leased assets under Scope 3 includes emissions from working facilities and premises which the Bank leases for its activities, and this also includes emissions from ATMs which the Bank leases from a service provider. For the first time the Bank is publishing information on some emissions from acquired equipment, i.e. computers and computer equipment.

Greenhouse gas emissions from flights (part of Scope 3)

In 2021 information on flights from the Bank’s accounting systems and from a data stream via Klappir was added. After the number of flights decreased substantially in 2020 and 2021, largely due to the Covid-19 pandemic, the number of business trips increased again in 2022 and therefore emissions from this item increased sharply compared with the previous year.

The Bank’s target of increasing the percentage of sorted waste to 90% by 2023 was highly ambitious. While significant progress was made in terms of sorting waste, the 90% target was not reached during the year. The percentage of sorted waste increased to 80.1% in 2022, and there was a limited amount of construction waste compared with 2020-2021.

The Bank is on the right track and maintains its 90% target on sorted waste.

Sorted waste

Travelling to and from work

Arion Bank has a policy on working from home. The policy offers greater flexibility in terms of where people work and a more varied working environment in step with changing times. Working from home on a more regular basis saves time and reduces the carbon footprint of commuting to and from work. The strategic application of remote working is therefore beneficial for employees, the company and society as a whole.In 2021 employees were given the opportunity to travel with eco-friendly electric scooters after the Bank reached an agreement with the company Hopp. Our employees used the scooters to commute to and from work, go to meetings and perform other tasks during working hours. 2022 was the first full year in which employees were offered the use of electronic scooters and by the end of the year 6,829 journeys had been recorded. It is pleasing to see how positive the response has been to this eco-friendly mode of transport.

In order to encourage more employees and customers to use electric and plug-in hybrid vehicles, the number of charging stations was increased from 16 to 54 at the Bank’s headquarters.

At the beginning of 2023 a survey was conducted among employees about their habits when travelling to and from work. Klappir Green Solutions conducted the survey and processed the results. The main results can be seen below, but it should be noted when comparing figures from 2020, 2021 and 2022 that the 2020 survey was conducted by another organization. The difference between years may therefore to some extent be due to different methodologies. The results show that the average emissions from transportation per employee in 2022 were 288 kgCO2e which is 4.4% more than the previous year.

The survey revealed that 84.7% of employees predominantly use a private car to travel to and from work, 9.8% cycle or walk and 5.6% use public transport. The majority of those who drive to work use cars which are powered by fossil fuels, or 54.4%, and 25.0% use hybrids or plug-in hybrids. A very small number use methane powered vehicles (0.6%), while a growing proportion use electric cars (19.7%).

Total emissions from employee journeys to and from work were 220.9 tCO2e in 2022, which represents an increase of 18% from 2021, and these emissions come under Scope 3 in the Bank’s environmental accounts. Despite the introduction of a policy on working from home, people went to their place of work more often in 2020 and 2021 and the number of employees also increased between years.

Means of transport used by employees

Employees’ vehicles - fuel type

Key figures

94%

Total volume of printed paper

has decreased by

66,5%

decrease in greenhouse gas emissions

from work vehicles

220,9 tCO2e

total emissions from employee

journeys

45,7%

decrease in greenhouse gas emissions

from own business premises

600

verified carbon units purchased

for emissions in 2022

288 kgCO2e

average emissions per employee from

travelling to and from work

The data and information published in the accounts are valid for 2022 and apply to Arion Bank’s core activities. Data linked to the Bank’s subsidiaries where they share premises with the Bank has been incorporated under emissions from leased out assets (Scope 3). Data from 2015-2021 is presented for comparison. 2015 is the base year for the Bank’s efforts to reduce greenhouse gas emissions from its operations.

Data for the Bank’s environmental accounts has been collected using data streams via Klappir Green Solutions. In cases where data on heating and electricity in place of work leased by the Bank is not available via Klappir or is hard to obtain, an estimate based on floorspace has been made.

Data is calculated retroactively for the period 2015 to 2021 using the latest information. Consequently, there are some discrepancies if these accounts are compared with previous environmental accounts.

Information on emissions from employee journeys to and from work is based on the results of the survey conducted by Klappir Green Solutions.

Examples of actions taken in the business to reduce greenhouse gas emissions and negative environmental impact:

- In 2022 floorspace was reduced from 17,500 m2 to 15,000 m2.

- 71% of all vehicles owned by the Bank are either plug-in hybrids or electric cars, and 100% of the cars owned by the Bank and used by employees for daily tasks (buying etc.) are plug-in hybrids or electric cars.

- We ask our suppliers on their focuses and performance with respect to environmental and climate issues.

- Employees have been able to apply for transport allowances ever since 2012. Arion Bank does its utmost to improve the health of its employees and to reduce greenhouse gas emissions from vehicles through its transport policy. The objective of the policy is to encourage employees to make greater use of environmentally friendly and efficient means of transport. Environmentally friendly transport refers to all modes of transport used to travel to and from work other than private cars, e.g. walking, cycling, getting a lift from others or using public transport. In 2022 almost 10% of employees used the transport allowance for at least some part of the year.

- We have developed strong partnerships, both in Iceland and abroad, in the field of environmental and climate issues. For more information on Arion Bank’s ESG rating, commitments, certifications and participation on collaborative projects on sustainability, see here.

Methodology for environmental accounting

When calculating Arion Bank’s environmental bottom line, we use The Greenhouse Gas Protocol which is a standardized methodology which has been implemented at a number of companies with good results. Arion Bank has underlined the importance of implementing its climate project within the framework of Icelandic and international legislation and regulations on the environment.

The diagram below describes the methodology according to which greenhouse gas emissions are divided into three categories, Scopes 1, 2 and 3. Broadly speaking emissions originate from the transportation of supplies to the company, from the company’s operations and from the transportation of goods and services from the company. The categories encompass three different scopes which are divided into direct and indirect impacts.